328 Business e-Banking FAQ

1. What is 328 Business e-Banking?

328 Business e-Banking is a one-stop internet banking platform for company customers.

2. Can I access 328 Business e-Banking any time?

328 Business e-Banking is available any time including, weekends and Public Holidays. Please refer to Q4 for the Service Hours and cut-off time for specific online services.

3. How do I set up the authorisation settings for 328 Business e-Banking?

You can choose your authorisation settings during the 328 Business e-Banking account opening process, where you also can set up different authorisation limits for different types of instructions.

4. What are the services times and cut-off times for 328 Business e-Banking?

| Service | Service Hours | Cut-Off Times | |

|---|---|---|---|

| Account Enquiry and Inward Remittance Enquiry | Monday-Friday | 24 Hours | N/A |

| Saturday / Sunday / Public Holidays | |||

| Cheque Book Request | Monday-Friday | 9:00 am-11:00 pm | N/A |

| Saturday / Sunday / Public Holidays | Not Available | ||

| Funds Transfer within Dah Sing Bank (Same Currency) | Monday-Friday | 24 Hours | N/A |

| Saturday / Sunday / Public Holidays | |||

| FPS Collection | Monday-Friday | 24 Hours | 11:00 pm |

| Saturday / Sunday / Public Holidays | N/A | ||

| Foreign Exchange Transfer | Monday-Friday | 8:30 am-2:30 am of next day | N/A |

| Saturday | 9:00 am-1:00 pm | ||

| Sunday / Public Holidays | Not Available | ||

| CHATS | Monday-Friday | 24 Hours | Currencies: HKD / USD / CNY / EUR: 4:30 pm |

| Saturday / Sunday / Public Holidays | N/A | ||

| Telegraphic Transfer | Monday-Friday | 24 Hours | Currencies: HKD / USD: 4:30 pm CNY (Cross-border): 3:30 pm THB / SGD / ZAR: 3:30 pm Other Currencies: 4:30 pm |

| Saturday / Sunday / Public Holidays | N/A | ||

| Bill Payment | Monday-Friday | 24 Hours | 4:30 pm |

| Saturday / Sunday / Public Holidays | N/A | ||

| Payroll | Monday-Friday | 24 Hours | 3:30 pm (One business day prior to payment date) |

| Saturday / Sunday / Public Holidays |

N/A |

||

| Autopay-out | Monday-Friday | 24 Hours | 3:30 pm (One business day prior to payment date) |

| Saturday / Sunday / Public Holidays | N/A | ||

| Fixed Deposit | Monday-Friday | 9:00 am-8:00 pm | N/A |

| Saturday | 9:00 am-1:00 pm | ||

| Sunday / Public Holidays | Not Available | ||

| MPF | Monday-Friday | 24 Hours* *Authorisation cannot proceed after Cut-Off Time |

5:30 pm |

| Saturday / Sunday / Public Holidays | N/A | ||

| Business Card Repayment | Monday-Friday | 24 Hours* *Authorisation cannot proceed after Cut-Off Time |

11:00 pm |

| Saturday / Sunday / Public Holidays | N/A | ||

5. Why is my group ID suspended?

For security reasons, we may suspend your group ID in some instances. If your group ID has been suspended, you should call our Customer Service Hotline at 2828 8159 to report the error code for further follow-up, or the applicant's company can complete the relevant maintenance form, sign according to signing requirements and submit the form to any of our branches for group ID reactivation.

6. How do I obtain and complete the 328 Business e-Banking Maintenance Form to amend my company's 328 Business e-Banking Service?

You can click here to download the 328 Business e-Banking Maintenance Form or obtain the Maintenance Form from any of our branches.

Please complete the Maintenance Form, sign in accordance with the signature requirements and submit the form to any of our branches. If you download and print the 328 Business Maintenance Form from our website, please sign on the bottom right corner of each page (the same authorised signature used in Section 9a) before submitting to us. The form will be processed within 3 business days after receipt of a valid Maintenance Form.

*Click here to view a sample of a completed 328 Business e-Banking Maintenance Form.

1. What is the recommended hardware and software for using 328 Business e-Banking?

Hardware:

- Intel Core 2 1.8GHZ CPU or above

- 1024 x 768 display resolution or above

- 2 GB RAM or above

Software:

- Windows 7.0 or above

- Microsoft Office 2010 or above.

- If you choose BCT as your MPF contribution, you can use the Flexi 2 System provided by BCT Financial Limited (For Payroll and MPF Contribution File Upload Services)

Browser:

Google Chrome / Microsoft Edge / Internet Explorer 11.0 or above (enabled with TLS 1.2 protocol)

Internet Access is required

2. What security measures are present in 328 Business e-Banking to ensure the highest level of security?

- 328 Business e-Banking is a VeriSign Secured Site. All information is sent via TLS encryption+ to protect you against unintentional information disclosure to third parties

- Login** with a unique Group ID, User ID and password

- SMS One-time Password is used for Administrators as Two-factor Authentication for login**and authorisation

- SMS One-time Password or Security Authentication, including Fingerprint Authentication, Face ID Authentication, Facial Recognition and Security Passcode Authentication is used for Approvers as Two-factor Authentication for login**and authorisation

- Automatic time-out Feature

+TLS encryption is employed to ensure confidentiality. TLS is an updated and more secure version of Secure Socket Layer (SSL). It is an internationally recognized standard for information security. All data and information transmitted between you and our Bank through the Internet is encrypted by TLS encryption.

**The Bank will send an email notification to your company email address registered with us once the Approver(s) and / or Administrator(s) has logged into 328 Business e-Banking / Mobile Banking successfully.

1. What is 328 Business Mobile Banking?

328 Business Mobile Banking allows you to use our online banking services on your mobile device. Our fast, convenient and secure mobile banking service enables you to stay on top of your finances anytime and anywhere.

2. Which services are available on 328 Business Mobile Banking?

328 Business Mobile Banking provides the following services for Maker and Approver:

- Account Enquiry

- Online Transaction Enquiry (including Intra-group Transfer, Third Party Account Fund Transfer Within DSB, CHATS, Telegraphic Transfer, FPS Payment, eDDA Registration, QR Code Generation and Scheduled Instruction Maintenance)

- Inward Transaction Enquiry (including Inward FPS Transactions and Inward Remittance)

- Change Password

- View Bank Messages

- Deposit Interest Rate and Foreign Exchange Rate Enquiry

- Payment Services (including Intra-group Transfer, Third Party Transfer Within DSB, CHATS and Telegraphic Transfer)

- FPS Services (including FPS Registration, FPS Payment, QR Code Generation and eDDA Enquiry)^^

- Scheduled Instruction Maintenance

- Template Maintenance

- Transaction Approval (for Approver only)

- Security Authentication (for Approver only)

^^Please click here to view more FAQs related to FPS Services.

328 Business Mobile Banking provides the following services to Administrator:

- Manage and Approve Administrative Instructions (including users, transactions and function group settings)

- View Activity Records

- View Bank Messages

- Change password

3. How can I access 328 Business Mobile Banking?

Download the "328 Business Mobile Banking" app on your iOS or Android mobile device from the App Store or Google Play Store.

4. Which mobile devices does 328 Business Mobile Banking support?

Our Mobile App can run on mobile devices with the following operating systems:

- iOS version 15.0 or above

- Android version 9.0 or above

5. Can I access 328 Business Mobile Banking out of Hong Kong?

You can access 328 Business Mobile Banking from anywhere, provided that you have an Internet connection. Your network provider may charge data roaming and SMS. For details, please contact your network provider.

6. How can I log into 328 Business Mobile Banking?

You can log into 328 Business Mobile Banking with your 328 Business e-Banking Group ID, User ID and password. You must be a 328 Business e-Banking customer in order to access 328 Business Mobile Banking. If you have not registered for 328 Business e-Banking, please visit any of our branches and submit the 328 Business e-Banking Application Form to apply for the service.

7. Is 328 Business Mobile Banking secure?

Same as 328 Business e-Banking, you must enter your Group ID, User ID and Password to log into 328 Business Mobile Banking. For additional security, you are required to complete Two-factor Authentication (2FA) using a SMS One-time Password (OTP) or Security Authentication when you log into 328 Business Mobile Banking.

8. Is my password for 328 Business e-Banking changed when I change the password for 328 Business Mobile Banking?

Yes. The login password for 328 Business e-Banking and 328 Business Mobile Banking are the same.

9. Can I download statements from 328 Business Mobile Banking?

The download statements function is not available on 328 Business Mobile Banking. If you need to download a statement, please use our 328 Business e-Banking service.

10. Can I still log into 328 Business Mobile Banking if I change my device?

Yes. You can log into 328 Business Mobile Banking with your 328 Business e-Banking Group ID, User ID and password. Please note that you cannot use the same Group ID and User ID to log into 328 Business e-Banking or Mobile Banking on more than 1 mobile device at the same time. Each Approver can only activate Security Authentication on one mobile device. For more information, please refer to FAQ#4 in "Security Authentication Services".

1. What is Security Authentication?

Security Authentication enables Approvers to log into 328 Business Mobile Banking and complete Two-factor Authentication when carrying out designated online transactions. Two-factor Authentication can be completed with Fingerprint Authentication, Face ID Authentication, Facial Recognition or Security Passcode Authentication.

2. I have already used SMS One-time Password (OTP) Authentication. Why do I need to activate Security Authentication for transaction approvals?

The Security Authentication Service replaces the Security Token for Two-factor Authentication for authorising transactions which cannot be approved by SMS OTP Authentication due to security reasons, including the following transactions:

- Fund Transfer or Remittance to non-registered third-party Accounts

- "FPS" Services

- Bill Payment to designated merchants

- Payroll

- Autopay-Out

3. How can an Approver activate Security Authentication Service?

The Approver must fulfil the following requirements:

- The relevant company must be an existing 328 Business e-Banking customer and 328 Business Mobile Banking user

- The Approver must have a registered mobile phone number with us for receiving SMS One-time Password (OTP)

4. Can an Approver activate Security Authentication on more than 1 mobile device?

Each Approver can only activate Security Authentication on 1 mobile device. If you want to change the mobile device used for Security Authentication, please use the new mobile device to activate the service again. After you successfully activate Security Authentication on the new mobile device, the original mobile device will be automatically deactivated and can no longer be used for Security Authentication.

5. Which devices can be used for Security Authentication?

The Security Authentication Service of 328 Business Mobile Banking no longer supports Fingerprint Authentication on Samsung Galaxy S10, Galaxy S10+, Galaxy Note 10 and Galaxy Note 10+.

Please click here to check the supporting mobile devices of Security Authentication

6. What should I do if my Security Authentication-enabled mobile device is lost or stolen?

Please contact our Customer Services Hotline on 2828 8188 (available 24 hours) immediately if your Security Authentication-enabled mobile device is lost or stolen. You can request us to suspend your Security Authentication service to prevent unauthorised access.

7. Why is Security Authentication disabled?

For security reasons, Security Authentication may be disabled when:- The biometric data on your device is changed (e.g. you add or delete fingerprints or reset your Face ID)

- You register the Service on another device for the same 328 Business Mobile Banking account

- You have accumulated 5 times of self-assigned security passcode failure

- You have accumulated 5 times of facial recognition failure;

- You instruct us to disable the service

In the event that Security Authentication is disabled, you will need to re-register or re-activate the service.

8. Will Security Authentication be disabled when I change the facial map on my Android device setting?

No. It is because this change will not affect the facial map registered when you activated Security Authentication in the 328 Business Mobile Banking.

9. What is "Security Passcode Authentication"?

The Security Passcode is a means used to verify your identity when you log into 328 Business Mobile Banking. For security reasons, you are required to follow the following password format:

- The password must consist of 8-15 letters and numbers;

- Symbols and spaces are not allowed; and

- The password is case sensitive

If you would like to reset your Security Passcode, you must deactivate Security Authentication first and then reactivate the service again.

10. Why do I have to enable Fingerprint Authentication / Face ID Authentication / Facial Recognition and Security Passcode Authentication at the same time?

For security reasons, Security Passcode Authentication can be used as an alternative Two-factor Authentication method in case you cannot authorise a transaction due to too many incorrect Fingerprint Authentication, Face ID Authentication or Facial Recognition Authentication attempts.

11. Is Fingerprint Authentication safe?

Fingerprint Authentication is a highly secure identity verification method. Only fingerprint(s) stored on your device can be used for Security Authentication Service. We therefore strongly recommend that you only store your own fingerprint(s) on your device and should not store or allow any third-party Fingerprint to be stored on your device. Your fingerprint data will not be stored in the 328 Business Mobile App or recorded by us. You can enable or disable Fingerprint Authentication anytime in the "Security Authentication Settings" after logging into 328 Business Mobile Banking (a SMS One-time Password for Two-factor Authentication is required to activate the service).

12. Is Face ID or Facial Recognition safe?

Face ID Authentication or Facial Recognition is a highly secure identity verification method. Only the Face ID stored on your device or facial map registered in 328 Business Mobile App can be used for Security Authentication Service. We therefore strongly recommend that you only store your own Face ID on your device only or register your facial map in 328 Business Mobile App and should not store or allow any third-party Face ID or facial map to be used on your device. Your Face ID or facial map will not be stored in the 328 Business Mobile App or recorded by us. You can enable or disable Face ID Authentication or Facial Recognition at anytime in "Security Authentication Settings" after logging into 328 Business Mobile Banking (a SMS One-time Password for Two-factor Authentication is required to activate the service). However, please note that when you use Face ID Authentication or Facial Recognition, there is a small chance of a false match (e.g. if you have a twin or sibling that looks alike or if you disable "Require Attention for Facial Recognition" in your device settings). Please read the Terms and Conditions carefully and accept the corresponding risks and consequences before enabling Face ID.

13. What should I do if an Approver leaves the company and is no longer authorised to manage the company's bank account?

In the case that an Approver has resigned or is no longer authorised to operate the bank account, the Administrators should delete the corresponding user account by going to "Management" > "User Settings" after logging into 328 Business e-Banking.

14. Can Administrators use the Security Authentication service?

No. Administrators can only use SMS One-time Password (OTP) as Two-factor Authentication to log into 328 Business Mobile Banking.

1. What instructions can be performed by using SMS OTP on 328 Business e-Banking?

You can perform the following instructions by using SMS OTP:

- Login

- Request Cheque Books++

- Approve Transactions++

- Administration of user settings for Administrator(s)***

++Only applicable to Approvers.

***Only applicable to Administrators.

2. Can I use SMS OTP to approve multiple transactions in one go on 328 Business e-Banking?

Yes. You can use SMS OTP to approve up to 10 transactions of the same transaction type in one go each time (except those related to FPS services).

3. How can I register and / or update the mobile phone numbers of 328 Business e-Banking Administrator(s) and / or Approver(s) to receive the SMS OTP?

You can register and / or update the mobile phone numbers of 328 Business e-Banking Administrator(s) and / or Approver(s) via 328 Business e-Banking or by visiting any of our branches to submit the form.

1. What is 328 Business Account (Express)?

328 Business Account (Express) is a type of business account for start-ups and SMEs. It offers a simplified and fast account opening experience and basic banking services. Holders of the account can also manage their banking transactions via our e-Banking and Mobile Banking platform.

2. Can I use all functions on 328 Business e-Banking and Mobile Banking?

Generally, except for Telegraphic Transfer service and any local remittance involving cross-border fund movement, company customers with a 328 Business Account (Express) can enjoy all other functions on our 328 Business e-Banking and Mobile Banking platform, including check account balances, anytime real-time transfers in HKD or RMB to or from bank accounts with other local participating banks via FPS, bill payments and more.

3. What should I do if I would like to use the Telegraphic Transfer service and local remittance involving cross-border fund movement?

You may visit any of our branches for information and application during services hours. Please click here to check the branch locations and service hours.

1. Can I use the 328 Business e-Banking or Mobile Banking service to check the details of all my accounts?

You can use the 328 Business e-Banking or Mobile Banking service to check the details of all the following accounts under the same name:

- Current Account

- Savings Account

- Loan Account

- 328 SME Express Money Instalment Loan (if applicable)

- 328 SME Tax Loan (if applicable)

- 328 SME Property Financing (if applicable)

- Fixed Deposit Account

2. Can I view account balances of my subsidiaries that maintain accounts with Dah Sing Bank?

In order to enquire and operate the accounts of your subsidiaries in 328 Business e-Banking and Mobile Banking, you are required to fill in and submit the 328 Business e-Banking Application Form for your subsidiaries to any of our branches to register these subsidiaries to your 328 Business e-Banking service.

3. Can I download my account transaction records?

Yes. You can download account transaction records in PDF or XLS format in 328 Business e-Banking.

4. Are account balances available on a real-time basis?

328 Business e-Banking and Mobile Banking gives you real-time updated account information. You can view your transaction history of the past 1 year (upon your successful opening of 328 Business e-Banking).

5. I have opened a new account. Why can't I find the account in 328 Business e-Banking?

If you have opened a new account, your Administrator is required to log into 328 Business e-Banking to refresh the account list by following the steps below:

- Administrator logs into 328 Business e-Banking and goes to "Management" > "List of Holder's Account"

- Click "Refresh"

- Confirm the account list. The account list will become effective once approved

You can click here to view a demo of 328 Business e-Banking.

6. Can I check the inward remittance records of my Dah Sing Bank account?

Yes, you can view the inward remittance records of your account by the following methods:

- Log into 328 Business e-Banking and go to "Cash Management" > "Enquiry" > "Inward Transaction Enquiry" > Select "Inward Remittance" in Transaction Type; or

- Log into 328 Business Mobile Banking and go to "Enquiry" > "Inward Transaction Enquiry" > Select "Inward Remittance" in Transaction Type

You must have opted into this service when applying for 328 Business e-Banking.

7. How long will records of inward remittance be kept for?

You can use 328 Business e-Banking and Mobile Banking to view inward remittance records for the past 3 months.

1. What kinds of e-Statements can I view on 328 Business e-Banking or Mobile Banking?

You can view and download the e-Statements of your Statement Savings Account, Current Account, Merchant Account and Business Card Account on 328 Business e-Banking or Mobile Banking. Both Makers and Approvers are authorized to view and download the e-Statements.

2. When can I view the new e-Statement?

Under normal circumstances, you can view e-Statements on 328 Business e-Banking or Mobile Banking within 7 working days of the issue date.

3. How long will an e-Statement be kept online?

The e-Statements from 26 Nov 2023 onwards will be retained for 7 years from the issue date.

4. I access my e-Statements on 328 Business e-Banking or Mobile Banking. Can I stop receiving a paper statements?

Unfortunately, currently the service of suppressing paper statement is not available.

5. Does the e-Statement Enquiry function needs to be pre-set by Administrator for Maker and Approver?

For Maker and Approver which have already set up can enquire and download e-Statements without modifying user settings. If Administrator needs to create new Maker and Approver, they can simply set up via the "Management" > "User Settings" > "Company Access Right", and select "Execute" or "Enquire" under the access rights of account number. The Maker and Approver can then view and download e-Statements.

1. How can I request a Cheque Book?

Your Approvers can log into 328 Business e-Banking or Mobile Banking to request a cheque book. This service is not applicable to Makers.

2. How will Cheque Book be sent to me?

The cheque book(s) will be sent to the Master Company's corresponding address by post.

1. How can I transfer funds to a third-party account within Dah Sing Bank?

You can transfer funds to registered or non-registered third-party accounts within Dah Sing Bank via the function of Third Party within DSB. To register a third-party account, submit an application form at any of our branches. You may also transfer funds to a non-registered third-party Dah Sing Bank account by using a SMS One-time Password or Security Authentication via 328 Business e-Banking or Mobile Banking.

Notes: EasiSave Mulitcurrency Accounts cannot be used as a Debit Account for CNY transactions.

2. What happens if I want to make a foreign currency transfer instruction on a public holiday?

If the transaction date of a foreign currency transfer instruction falls on a public holiday, the instruction will be processed on the next business day.

3. Can I make fund transfer involving foreign exchange and what is its service hours?

Yes, you can make FX transactions to your intra-group accounts via "Intra-group FX Transfer" or Third Party Dah Sing Bank account via "Third Party FX Transfer Within DSB". The service hours for fund transfer involving foreign exchange: Monday to Friday (8:30 am - 2:30 am of the next day) and Saturday (9:00 am - 1:00 pm).

4. What should I pay attention to when submitting an FX transaction on Saturday via 328 Business e-Banking or Mobile Banking?

On Saturday (not including a Saturday that is public holiday), FX transactions should be submitted within 9:00 am - 1:00 pm and are subject to the per-transaction FX limit and daily FX limit set by Dah Sing Bank, Limited (DSB). DSB reserves the right to reject any transaction which exceeds the daily and / or per-transaction FX limit without prior notice. The daily and per-transaction FX limits are determined at the sole discretion of DSB. In case of any disputes, the decision of DSB shall be final.

1. What currency can be used in CHATS for transfer?

Customers can place fund transfer instructions in eligible currencies including HKD, USD, EUR or CNY to the beneficiaries who maintained accounts with local participating banks via CHATS.

Note: EasiSave Mulitcurrency Accounts cannot be used as a Debit Account for CNY transactions.

2. Is there a different cut-off time for transfer in different currencies?

Please refer to our Website regarding the cut-off time for transfer in different currencies.

3. What is the CHATS transaction fee?

For service charges, please refer to the Bank Service Charges on our Website.

4. Will receiving banks impose additional charges?

Some receiving banks and correspondence banks may impose additional charge(s) and the pricing is subject to change from time to time. Please refer to the receiving banks.

5. What is the difference between the Charge Indicators of CHATS?

- There are two CHATS Charge Indicators, i.e. "BEN" and "SHA":

- By choosing "BEN", both DSB's charges and other bank's charges will be paid by the beneficiary account

- By choosing "SHA", DSB's charges will be paid by the debit account, and the other beneficiary bank's charges will be paid by beneficiary account. (Since in "BEN", you are using "other bank", we suggest you also use "other bank" here for the sake of consistency, except when you have a specific purpose / meaning for using "other beneficiary bank" here)

- If remittance amount is less than the fees and charges incurred, we will reject the transaction

6. Will there be any additional charges if the remittance instruction contains Chinese characters?

Yes. An additional charge will apply. For details of service charges, please refer to the Remittance of Bank Service Charges on our Website.

1. How can I place fund transfer instructions to the beneficiaries in local and overseas banks?

You can place fund transfer instructions to the beneficiaries in local and overseas banks through the SWIFT network.

2. What should I pay attention to when submitting a CNY cross-border remittance to mainland China?

Please select the "Purpose of Remittance" before submitting a CNY remittance to Mainland China. After submitting a CNY cross-border remittance instruction online, we will contact you to request supporting documents for verifying the payment purpose (such as invoices or payment orders which state the buyer, seller and transaction amount). You are required to provide the requested documents within 7 business days. The remittance may be delayed or rejected if the documents are not provided within this period.

Note: EasiSave Mulitcurrency Account cannot be used as Debit Account of CNY transactions.

3. What is the Telegraphic Transfer transaction fee?

For service charges, please refer to the Bank Service Charges on our Website.

4. Will receiving banks impose additional charges?

Some receiving banks and correspondence banks may impose additional charge(s) and the pricing is subject to change from time to time. Please refer to the receiving banks.

5. What is the difference between the Charge Indicators of Telegraphic Transfer?

- Charge Indicator of Telegraphic Transfer can be divided into 3 options:

- By choosing "BEN", the DSB's charges and the other bank's charges will be paid by the beneficiary account.

- By choosing "SHA", the DSB's charges will be paid by debit account, and other beneficiary bank's charges will be paid by the beneficiary account (Since in "BEN", you are using "other bank", we suggest you use "other bank" here for the sake of consistency, except when you have a specific purpose / meaning for using "other beneficiary bank" here)

- By choosing "OUR", DSB's charges and the other bank's charges will be paid by the debit account

- If remittance amount is less than the fees and charges incurred, we will reject the instruction.

6. Will there be any additional charges if the remittance instruction contains Chinese characters?

Yes. An additional charge will apply. For details of service charges, please refer to the Remittance of Bank Service Charges on our Website.

1. What account type is accepted for bill payment?

Bill Payment only accepts payments by Savings or Current Accounts maintained with us.

2. What bills can be paid?

You can make payment via the Bill Payment service by following the steps below to over 800 major merchants in Hong Kong.

1. Log into 328 Business e-Banking > "Cash Management" > "Payment" > "Bill Payment", or

2. Log into 328 Business Mobile Banking > "Payment" > "Bill Payment"

You may view the merchant list by logging into 328 Business e-Banking.

3. When will the funds be transferred to the merchant of a bill payment transaction?

If instructions are received before 4:30pm (Monday - Friday), the payment amount will be transferred to the merchant on the same day. If instructions are received during the following periods, the transaction will be handled on the next business day

- After the mentioned cut-off time, or

- On Saturdays / Sundays / Public Holidays, or

- When Typhoon Signal No.8 or above or Black Rainstorm warning is hoisted

1. Do I need to apply if I want to use Payroll Service in 328 Business e-Banking?

Yes. You are required to apply for the service during the 328 Business e-Banking application or whenever needed, the applicant company can at any time complete the relevant maintenance form, sign according to signing requirements and submit the form to any of our branches to apply for the service.

2. What currency can be used in Payroll Services?

The debit currency of payroll instruction only supports HKD at the moment.

3. How can I submit a payroll instruction to 328 Business e-Banking?

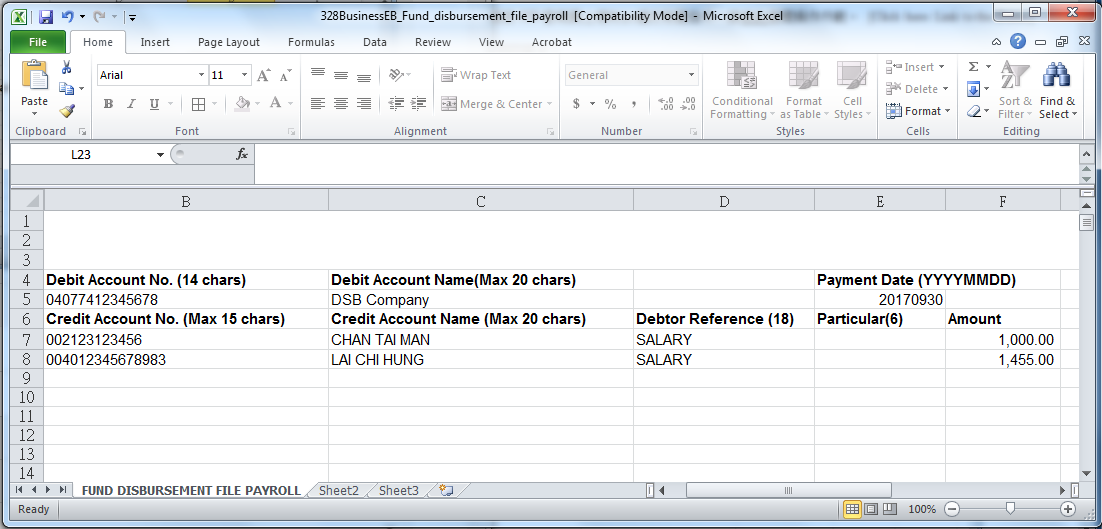

You need to fill in the payroll file and upload the completed file to 328 Business e-Banking for further processing. Please click here to view the demo.

4. How can I download the Payroll File Template?

You may log into 328 Business e-Banking > "Download Centre" to download the file template.

5. What should I be aware of when I am filling the Payroll File?

- When opening the payroll file, "Enable Editing" and / or "Enable Content" may pop out. You must click the relevant message box before you can input the contents.

- The payroll file cannot contain Chinese character.

- The Debit Account must be pre-registered by application at our branch.

- Input the beneficiary's full name so as to fulfill beneficiary bank's / participant's requirement(s) on the customer name verification.

- Add Bank Code (e.g. 040) before the Account Number. Please use the account number for autopay services which is printed on the account's monthly statement. For Dah Sing Bank accounts, please use the account number for autopay services which is printed on the account's monthly statement.

6. What should I be aware of when I am crediting both salary and commission?

When completing the Payroll File, you should specify clearly in the Debtor Reference whether it is a salary or commission payment.

7. How do I cancel a submitted payroll instruction?

Approver can log into 328 Business e-Banking (328 Business e-Banking > "Cash Management > Enquiry > Online Transactions Enquiry") to cancel the approved Payroll instructions before the cut-off time (i.e. 3:30 pm of the preceding business day prior to the relevant payment date).

8. When will the employee receive the salary payment?

Provided that the employer account is maintained with sufficient payroll funds and the payroll file (approved and no error) has been successfully submitted to 328 Business e-Banking before the cut-off time, salary payment can be made to a beneficiary account on the payment day (depending on the beneficiary bank's processing time).

9. Can I make payroll payments to staff whose bank accounts are maintained outside Hong Kong?

Payroll Services only allows payroll payments to accounts maintained with local banks at the moment.

10. How can I know if the Beneficiary has received the payment?

You can check the e-Report for latest payment status. You can download the e-Report via 328 Business e-Banking (328 Business e-Banking > "Download Centre > Autopay-out / Payroll Report "). The e-Report will be available at around 4:00 pm on the relevant payment date.

1. Do I need to apply if I want to use Autopay-Out Service in 328 Business e-Banking?

Yes. You are required to apply for the service during the 328 Business e-Banking application or whenever needed, the applicant company can at any time complete the relevant maintenance form, sign according to signing requirements and submit the form to any of our branches to apply for the service.

2. What currency can be used in Autopay-Out?

The debit currency of Autopay-Out instruction only supports HKD at the moment.

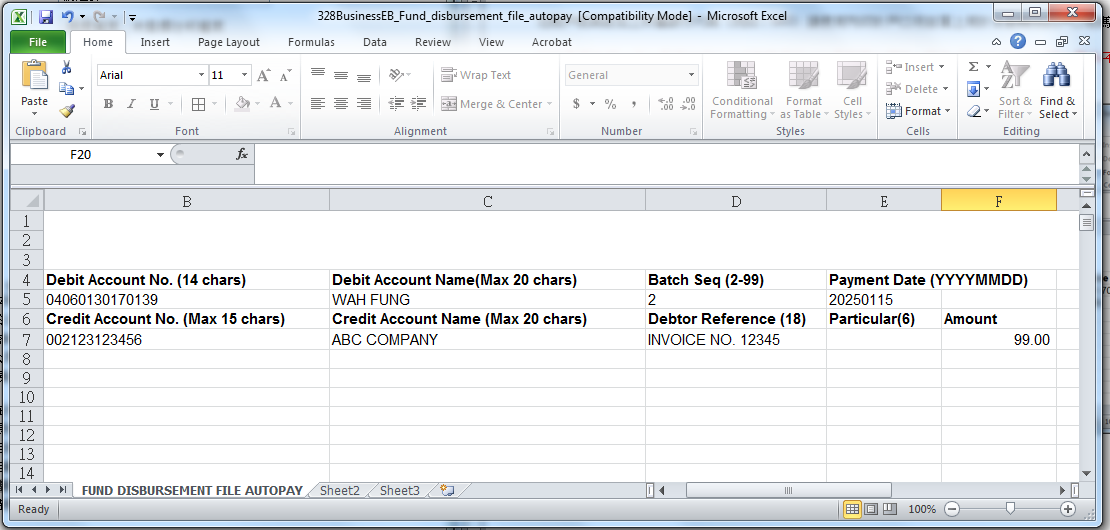

3. How can I submit an Autopay-Out instructions to 328 Business e-Banking?

You need to fill in the Autopay-Out file and upload the completed file to 328 Business e-Banking for further processing. Please click here to view the demo.

4. How can I download the Autopay-Out File Template?

You can log into 328 Business e-Banking > "Download Centre" to download the file template.

5. What should I be aware of when I am filling the Autopay-Out File?

- When opening the Auto-pay out file, "Enable Editing" and / or "Enable Content" may pop out. You must click the relevant message box before you can input the contents.

- The Autopay-Out file cannot contain Chinese characters.

- The Debit Account must be pre-registered by submitting forms to our branches.

- Input the beneficiary's full name so as to fulfill beneficiary bank's / participant's requirement(s) on the customer name verification.

- Add Bank Code (e.g. 040) before the Account Number. For Dah Sing Bank accounts, please use the account number for autopay services which is printed on the account monthly statement.

- Default is "2" for Batch Seq (2-99). Each file with the same "Batch Seq (2-99)" number can only be uploaded and submitted once per day. If you need to upload 2 or more files on the same day, please input "3" or after in "Batch Seq (2-99)".

6. How do I cancel a submitted Autopay-Out instruction?

Approver can log into 328 Business e-Banking (328 Business e-Banking >“Cash Management > Enquiry > Online Transactions Enquiry") to cancel the approved Autopay-out instructions before the cut-off time (i.e. 3:30 pm of the preceding business day prior to the relevant payment date).

7. When can the credit account receive the funds?

Provided that the debit accounts is maintained with sufficient funds and the Autopay-Out file (approved and with no errors) has been successfully submitted to 328 Business e-Banking before the cut-off time, Autopay-Out payment can be made to a beneficiary account on the payment date (depending on the beneficiary bank's processing time).

8. Can I make Autopay-Out payments to a bank account that is maintained outside Hong Kong?

Autopay-Out Service only supports Autopay-Out payments to local banks at the moment.

9. How can I know if the Beneficiary has received the payment?

You can check the e-Report for latest payment status. You can download the e-Report via 328 Business e-Banking (328 Business e-Banking > "Download Centre > Autopay-out / Payroll Report "). The e-Report will be available at around 4:00 pm on the relevant payment date.

1. What currencies of fixed deposit can be placed in 328 Business e-Banking?

You can place over 10 foreign currencies via 328 Business e-Banking / Mobile Banking. Foreign currencies include: RMB, USD, JPY, EUR, etc. To place a Fixed Deposit, the Fixed Deposit currency and the currency selected for the "Debit Account" and the "Credit Account" in the maturity or uplift instruction should be the same.

2. Can fixed deposit be uplifted before maturity?

No. Pre-mature uplift of Fixed Deposit is not allowed in 328 Business e-Banking / Mobile Banking. If you need to uplift the fixed deposit before the maturity, please visit any of our branches. We reserve the right not to pay interest on deposits withdrawn before the maturity date and may levy a penalty charge.

3. How are interest rates and the exchange rates determined?

The interest rate and the exchange rate (if any) for the Fixed Deposit will be determined by us based on the prevailing fixed deposit board rate and the exchange rate on the Fixed Deposit placement date (subject to the completion of approval). The interest rate of JPY is calculated and rounded to the nearest integer while the interest rate of other currencies is calculated and rounded to 1 decimal place.

4. How can I amend the Fixed Deposit maturity instruction?

You can log into 328 Business e-Banking > "Cash Management" > "Fixed Deposit" > "Fixed Deposit Amendment" or log into 328 Business Mobile Banking > "Fixed Deposit" > "Fixed Deposit Amendment" to amend the maturity instruction of the fixed deposit. Amendment of maturity instructions through 328 Business e-Banking / Mobile Banking will only be accepted if the instruction is given at least 1 business day before the maturity date.

1. Can I set an instruction that is dated for the future?

Instructions can be created with a future value date within 45 calendar days in advance or scheduled with 6 consecutive months on a designated date of each month (only allowed to set from the 1st to 28th of the month). For Bill Payment and Payroll Services, if the execution date of a scheduled date falls when Typhoon Signal No.8 or above or Black Rainstorm warning is hoisted or it falls on Saturdays, Sundays or Public Holidays, will be processed on the next business day of the scheduled date.

2. Will I be notified when the instruction has been executed?

Under normal circumstances, the scheduled instruction will be handled before 12:00 pm on the scheduled instruction date. An email and SMS will also be sent to the registered email address and mobile phone number after the execution of the scheduled instruction. You can also check the status of the instruction through 328 Business e-Banking.

3. Can I amend scheduled instructions?

You can amend the Scheduled Instruction in 328 Business e-Banking > "Scheduled Instruction Maintenance" or in 328 Business Mobile Banking > "Scheduled Instruction Maintenance". However, an amended scheduled instruction requires approval from the approver again.

4. What type of scheduled instructions can I manage in 328 Business e-Banking and Mobile Banking?

You can manage the following scheduled instructions in 328 Business e-Banking and Mobile Banking:

- Intra-group Transfer

- Third Party Account Fund Transfer Within DSB

- CHATS

- Telegraphic Transfer

- Bill Payment (For 328 Business e-Banking Only)

- FPS Payment

1. What is FPS?

You can use the FPS service to make real-time transfers in HKD or CNY to other local participating bank accounts or receive HKD or CNY funds from other local participating bank accounts.

2. What is FPS Proxy ID?

FPS Proxy ID means the unique identifier, including mobile phone number, email address or FPS ID, registered in FPS to identify the account of a customer.

3. What is FPS ID?

FPS ID means a unique number randomly generated and associated with the account of a customer to identify the account. You have to register with FPS to obtain your FPS ID in order to receive payment or funds transfer via FPS service.

4. How can I register to obtain my FPS ID?

- Log into 328 Business e-Banking and go to "Cash Management" > "FPS Services" > "FPS Registration"; or

- Log into 328 Business Mobile Banking and go to "FPS Services" > "FPS Registration"

If you are a Corporate Customer, your FPS ID will be activated immediately after registration and you can receive payments or transfer funds. If you are a Merchant Customer, your FPS ID will be activated no earlier than 10 working days after you submit your application (the date on which the relevant Merchant Payment Acceptance Services Agreement is signed). You will receive notification from our staff once your ID has been activated.

5. Which currencies does the FPS transfer service support?

FPS supports HKD and CNY transfers. You can transfer funds in HKD or CNY to beneficiaries who hold a HKD or CNY corporate or personal account with other local participating banks. Please note that FPS does not support cross-currency transactions.

6. How can I transfer funds via FPS?

You can transfer funds by the following methods:

- Entering a bank account number, including registered or non-registered third-party accounts with other local participating banks (if you need to register the beneficiary account(s) maintained with other local participating banks for fund transfers, please visit any of our branches and complete the 328 Business e-Banking Maintenance Form); or

- Entering the FPS Proxy ID of the beneficiary's account, including the FPS ID, mobile phone number and email address; or

- Scanning a QR code (only for 328 Business Mobile Banking)

7. What should I pay attention to when I enter the "Bill Number / Reference" for FPS payment transactions?

When transferring funds to merchants via an FPS Proxy ID, "Bill Number / Reference" is a mandatory field. You can enter the bill number of the merchant or other reference in order to identify the transaction. The "Bill Number / Reference" cannot contain Chinese characters and special characters and must be no more than 25 characters in length. Please contact the relevant merchant for details of the bill number.

8. Can I transfer funds to other Dah Sing Bank third-party accounts via "FPS Payment"?

You cannot use the "FPS Payment" to perform intra-bank fund transfers to a beneficiary account at Dah Sing Bank, i.e. from one Dah Sing Bank account to another Dah Sing Bank account. If you want to transfer funds between Dah Sing Bank accounts, please use the Third Party Transfer service of 328 Business e-Banking.

9. What happens if I cancelled my FPS ID?

If the FPS ID has been cancelled, all the inward fund transfer transactions via FPS ID will be invalid, automatically cancelled or rejected.

10. What are the differences between FPS, eDDA, CHATS, Telegraphic Transfer and Autopay-Out services for fund transfer?

| Beneficiary Account | Supported Currency | Credit Turnaround Time | Special Features | |

|---|---|---|---|---|

| FPS | Local participating bank accounts |

HKD and CNY | Normally, fund transfers via FPS will be processed in real time (subject to the practice of receiving bank) for instant transfer and on the execution date for scheduled transfer. | Supports instant and scheduled transfers |

| eDDA | Local participating bank accounts |

HKD and CNY | Normally, fund transfers via eDDA will be processed on the payment day. | Supports instant transfers after the instruction becomes effective |

| CHATS | Local bank accounts |

HKD, CNY, USD and EUR | Normally, the funds will be available on the payment day whenever the request is made before the cut-off time on clearing day. | Supports same day and scheduled transfers |

| Telegraphic Transfer |

Local bank accounts and other bank accounts |

HKD, USD, CNY, EUR, THB, SGD and other currencies |

Normally, the Bank will send out the telegraphic transfer on the payment day whenever the request is made before the cut-off time on clearing day. | Supports same day and scheduled transfers |

| Autopay-Out | Local bank accounts |

HKD | The funds will be debited from the debit account 1 clearing day before the payment date; payees will receive the fund on the payment day if the beneficiary accounts are maintained with the Bank whereas payees whose beneficiary accounts are not maintained with the Bank will normally receive the funds from their accounts 1 clearing day after the payment day. | Supports transfer in bulk |

The service charges for the above services are different. Please refer to the Bank Service Charges on the Bank's Website.

11. Are there any service charges for using FPS inward transfer?

If you are a Corporate Customer, there is no charge for using the FPS inward transfer service. If you are a Merchant Customer, charges are subject to the relevant terms and conditions and / or service agreement(s) entered into with the Bank. For the charges of using other services, please refer to the Bank Service Charges on the Bank's Website.

12. How can I view inward FPS payment transaction(s)?

You can view the inward FPS payment transaction by the following methods:

- Log into 328 Business e-Banking and go to "Cash Management" > "Enquiry" > "Inward Transaction Enquiry" > Select "Inward FPS Transaction" in Transaction Type; or

- Log into 328 Business Mobile Banking and go to "Enquiry" > "Inward Transaction Enquiry" > Select "Inward FPS Transaction" in Transaction Type.

13. How can I confirm whether an outward FPS payment was completed successfully?

You can view the status of outward FPS payment transactions by the following methods:

- Log into 328 Business e-Banking and go to "Cash Management" > "Enquiry" > "Online Transaction Enquiry"; or

- Log into 328 Business Mobile Banking and go to "Enquiry" > "Online Transaction Enquiry".

14. Can I amend or cancel a submitted FPS instant payment instruction after approval?

Once the submitted FPS instant payment instructions are authorised, they cannot be amended or cancelled. Please make sure the transfer details are correct before submission and approval.

15. Can I schedule an FPS payment instruction for a future date?

Yes. You can schedule an FPS instruction for a future date within the next 45 calendar days (including Saturdays, Sundays and public holidays).

Please note that approved scheduled FPS payment instructions which are approved and submitted cannot be amended or cancelled after 9:30 am on the same date as the payment execution date.

16. What are the features of FPS Service for Corporate Customer and Merchant Customer?

For the service features of Corporate Customer and Merchant Customer, please refer to below.

| Corporate Customer | Merchant Customer who has successfully registered for the FPS Merchnat Payment Acceptance Service |

|---|---|

| 1. Easy Collect via QR Code | 1. Easy Collect via QR Code |

i) Single QR Code Generation

|

i) Single QR Code Generation

|

| ii) Multiple QR Code Generation Can generate multiple QR codes through e-Banking |

|

| 2. Other FPS Collection Services Can receive payment through debit account number of Payer, FPS ID and eDDA Registration |

2. Other FPS Collection Services Can receive payment through debit account number of Payer, FPS ID and eDDA Registration |

| 3. Other FPS Services FPS Registration, FPS Payment and eDDA Registration |

3. Other FPS Services FPS Registration, FPS Payment and eDDA Registration |

| 4. Usage of FPS Name(s) and Logo(s) Cannot use any FPS Name(s) or FPS Logo(s) or any QR codes displaying the FPS Name(s) and Logo(s), whether for internal or external purposes |

4. Usage of FPS Name(s) and Logo(s)

|

17. How can I apply for the FPS Merchant Payment Acceptance Service and become a Merchant Customer?

If you would like to apply for the FPS Merchant Payment Acceptance Service and enjoy comprehensive payment acceptance services, please call the Merchant Service Hotline on 2828 8189 during office hours (Monday to Friday 9:00am - 5:45pm).

18. Why was the FPS transaction rejected by the beneficiary bank?

The beneficiary bank may reject the transaction if the beneficiary name does not exactly match the beneficiary name in its bank record or the account number is incorrect. Please ensure that the beneficiary name and account number are correct before setting up the transaction. You may log in to 328 Business e-Banking ("Cash Management" > "Enquiry" > "Online Transaction Enquiry") / Mobile Banking ("Enquiry" > "Online Transaction Enquiry") to check the relevant reasons and see further details in the remarks section of the transaction details.

19. I received the "FPS Payment Transaction Reminder Notification" email notification. Is there any action that I need to take?

If you receive the "FPS Payment Transaction Reminder Notification" email notification, it means that the relevant FPS payment transaction was accepted by the beneficiary bank at its discretion even the payee name is mismatch. In order to ensure the FPS payment transactions will be processed successfully in future, you should ensure that the beneficiary name is correct when setting up the transaction or update the registered payee record (if any). You may log in to 328 Business e-Banking ("Cash Management" > "Enquiry" > "Online Transaction Enquiry") / Mobile Banking ("Enquiry" > "Online Transaction Enquiry") to check the relevant reasons and see further details in the remarks section of the transaction details.

20. Why was the inward FPS payment transaction credit to my account rejected by your Bank?

The transaction was rejected by our Bank as the payee name does not exactly match the account name in our record or the account number is incorrect. To ensure the transactions can be successfully processed, please notify the payer to provide your correct name and account number in its payment instruction in future.

1. What is eDDA?

eDDA is an electronic authorisation by a payer for a payee to debit its account. Through 328 Business e-Banking, an eDDA instruction to send or collect money can be registered with other companies or individuals. Please note that the eDDA instruction is not yet effective until it is accepted by other side.

2. What currencies can be used in eDDA?

eDDA supports 2 currencies, i.e. HKD and CNY. You can place a HKD or CNY eDDA instruction. Please note that this service does not support cross-currency transactions.

3. How can I register an eDDA instruction?

If you are the payer, you can register an eDDA instruction using the payee's account number at other local participating banks (registered or non-registered third-party accounts) or FPS Proxy ID (including FPS ID, mobile phone number or email address). If you need to register third-party beneficiary account(s) maintained with other banks, please visit any of our branches to complete the 328 Business e-Banking Maintenance Form.

4. When will an eDDA instruction become effective following submission?

The eDDA instruction will not become effective until it has been accepted by the other side. In payer mode, your eDDA instruction must be accepted within 1 day upon submission date of the eDDA instruction, otherwise, the eDDA instruction will be automatically cancelled. You can view the status and details of your eDDA instruction you submitted by the following methods:

- Log into 328 Business e-Banking and go to "Cash Management" > "FPS Services" > "eDDA Registration"; or

- Log into 328 Business Mobile Banking and go to "FPS Services" > "eDDA Registration"

5. How can I know if there is an inward eDDA request sent by other side?

When we receive an inward eDDA request from other banks to your company, we will send an email notification to your registered email address. In payee mode, the inward eDDA instruction will be automatically accepted and become effective; In payer mode, you must accept the eDDA request within 5 days upon submission date of the eDDA instruction. Otherwise, the eDDA request will be automatically cancelled. Please note that the inward eDDA request is not yet effective until the instruction is accepted by your company.

6. How can I authorise or reject the inward eDDA request after I received it?

You may log into 328 Business e-Banking ("Cash Management" > "FPS Services" > "Inward eDDA Request") to accept or reject the inward eDDA instruction on or before the designated date. Please note that the inward eDDA request is not yet effective until the instruction is accepted by your company.

7. Can I amend or cancel my eDDA instruction which is already successfully registered?

You can amend or cancel the eDDA instruction which is already successfully registered with the other side at any time. Please note that the amendment or cancellation of eDDA requests is not yet effective until the instruction is accepted by the other side.

1. What is FPS Collection?

Through FPS Collection service, you can collect money in one go from more than 1 payer who has already successfully registered an effective eDDA instruction with your company.

2. How can I submit an FPS Collection instruction to 328 Business e-Banking?

You need to fill in the FPS Collection file and upload the completed file to 328 Business e-Banking for further processing.

3. How can I download the FPS Collection File Template?

You can log into 328 Business e-Banking > "Download Centre" to download the FPS Collection file template.

4. What should I be aware of when I am filling in the FPS Collection File?

- When opening the FPS Collection file, "Enable Editing" and / or "Enable Content" may pop out. You must click the relevant message box before you can input the contents

- You must successfully pre-register an eDDA instruction with the payer. Please refer to related eDDA FAQs for details

- FPS Collection can only support one single currency in one collection file

- All payer details input to the file must be the same as the details registered in the eDDA instruction

- The FPS Collection file cannot contain Chinese characters

- Add Bank Code before the Account Number

5. How can I cancel a submitted FPS Collection instruction?

All the approved and submitted FPS Collection instructions cannot be cancelled. Please make sure all information is correct and valid before uploading the file.

6. Can I collect payment from bank accounts maintained outside Hong Kong?

FPS Collection only supports money collection from accounts at local participating banks.

1. What is the purpose of the QR code generated?

The QR code generated is for the payer to scan and pay you via FPS. You can generate your HKD or CNY QR code for the payer to scan and pay.

2. How do I generate a QR code for receiving funds?

- Before generating a QR code, you need to register for the FPS service and obtain your FPS ID on 328 Business e-Banking or Mobile Banking

- After completing the registration process, you can submit QR Code Generation instructions by the following methods:

- Go to 328 Business e-Banking > "Cash Management" > "FPS Services" > "Easy Collect via QR Code" > "QR Code Generation"; or

- Go to 328 Business Mobile Banking > "FPS Services" > "QR Code Generation"

- The QR codes will be generated after the instruction has been approved. Individuals can pay you by scanning your QR code

3. Can I amend the payment details after scanning the QR code from the payee?

If the payee has entered the payment details (i.e. account number, currency, transaction amount and bill number / reference) when generating the QR code, you cannot amend the details after the QR code has been scanned. If the payee did not enter the transaction amount when generating the QR code, you have to input the transaction amount after scanning the QR code when performing an FPS fund transfer.

4. How can I download QR code(s) that I recently generated via 328 Business e-Banking or Mobile Banking?

You can download QR code(s) by the following methods:

- Log into 328 Business e-Banking and go to "Cash Management" > "FPS Services" > "Easy Collect via QR Code" > "QR Code Download Centre"; or

- Log into 328 Business e-Banking and go to "Cash Management" > "Enquiry" > "Online Transaction Enquiry"

You can also share QR codes by logging into 328 Business Mobile Banking and go to "Enquiry" > "Online Transaction Enquiry".

5. Can I receive funds via QR code in real-time?

Normally, fund transfer via QR code will be processed in real-time by us. You can instantly receive funds once the payer pays you via QR code (Note: Regarding the practice of the paying bank, it depends).

6. If the FPS ID of my company has been changed, can I continue using the QR code generated with that cancelled FPS ID for receiving funds?

No. The transaction will be rejected. If the FPS ID of your company has been changed, please re-generate the QR code with the new FPS ID for receiving funds.

7. What should I be aware of when I am filling in the Multiple QR Code Generation file?

- When opening the FPS Multiple QR Code Generation file, "Enable Editing" and / or "Enable Content" may pop out. You must click the relevant message box before you can input the contents

- You must input the currency (i.e. HKD and or CNY)

- HKD and CNY can be input in the same file for QR code generation

- FPS Multiple QR Code Generation file cannot contain Chinese character

- You must input within 25 characters for Bill Number / Reference

8. Do I need to enter the bill number / reference when I generate a QR code for receiving funds via FPS?

If you are a Corporate Customer, a bill number / reference is not required when you generate a QR Code for receiving funds via FPS. If you are a Merchant Customer, a bill number/reference must be entered.

9. Why can't I download QR code(s) that I recently generated via 328 Business e-Banking or Mobile Banking?

Corporate Customers cannot use any FPS name(s), FPS logo(s) or QR codes displaying the FPS name(s) and logo(s), whether for internal or external purposes. If you are a Corporate Customer and the QR code(s) that you recently generated via 328 Business e-Banking or Mobile Banking contain FPS name(s) and Logo(s), they are no longer available for download.

1. What currencies can be used for Business Card Repayment?

Card repayment for the HKD card account can only be settled in HKD, while card repayment for the CNY card account can only be settled in CNY.

2. How can I view my Business Card e-Statement?

You can check Business Card e-Statements in the following ways:

1. Log into 328 Business e-Banking > "Business Card" > "Enquiry" > "Business Card Enquiry", or

2. Log into 328 Business Mobile Banking > "Business Card" > "Business Card Enquiry"

3. How can I make card repayments?

You can log into 328 Business e-Banking or 328 Business Mobile Banking > "Business Card" > "Business Card Repayment" and select the business card and debit account, input the amount and other information to make card payments.

4. How can I check the transaction history during a month (before the monthly statement can be generated)?

You can log into 328 Business e-Banking > "Business Card" > "Enquiry" > "Business Card Enquiry" or 328 Business Mobile Banking > "Business Card" > "Business Card Enquiry" to check transaction history.

5. How can I check other staff's card transaction history?

You can log into 328 Business e-Banking > "Business Card" > "Enquiry" > "Business Card Online Transaction Enquiry" or 328 Business Mobile Banking > "Business Card" > "Business Card Online Transaction Enquiry" and search for the transaction history of all the business cards of your staff under the company.

1. What type of instructions can I enquire in Transaction Centre?

Transaction Centre allows users to enquire or amend transaction instructions. By using the Transaction Centre:

- Makers can enquire or amend the pending instructions and enquire completed transactions made

- Approvers can enquire and process the instructions which are pending for approval and enquire all completed transactions

- Administrators can enquire and process administration instructions.

2. How long is the transaction history that can be enquired?

You can enquire the transactions performed through 328 Business e-Banking over the past 1 year. Transactions are displayed with a 1-month data range. The function of enquiry and amendment are only applicable to users with appropriate access rights, Administrator can view and amend the access rights by logging into 328 Business e-Banking at any time.

3. When will the pending instructions be cancelled?

The pending instructions will be auto-rejected after 7 days from the creation date or last authorisation date.

4. If the Maker has already set up an instant instruction while the instruction is pending for approval, when will the instruction be executed?

After the Maker sets up the instruction, the instruction will only be executed after the approval is completed. After the instruction is approved, the instruction will be executed on the scheduled date (depending on the cut-off time of the service). If the scheduled date of the instruction was past and the approval time but is still before the cut-off time of the day, the instruction will be executed immediately

1. What are the functions available to the Administrator, Approver and Maker?

Administrator:

The Administrator(s) is(are) the person(s) nominated by the Master Company granted overall control to manage the group's 328 Business e-Banking Service including:

- List of Holder's Accounts Enquiry

- Activity Record Enquiry

- Beneficiary Accounts Management

- ATM Card Settings

- Business Card Settings

- Contract Limit Setup*

- Transaction Limit Maintenance (to amend the self-defined daily maximum transaction limit amount which cannot exceed the Contract Limit defined on the application form of 328 Business e-Banking Service or during first-time login)

- User Management

- Create Maker(s)

- Create Approver(s)*

- Delete / Suspend Maker(s) and Approver(s)

- Reset Login Password for Maker(s) and Approver(s)

- Unlock SMS OTP for Approver(s)

- Deactivate Security Authentication Service for Approver(s)

- Manage Function Access rights for Maker(s) and Approver(s)

- Function Group Settings

- Authorization Settings* and Enquiry

- User Management Control Settings (either dual or single management control)*

*Functions are available during first-time login 328 Business e-Banking only. The applicant company should submit 328 Business e-Banking Maintenance Form to any of our branches if amendment is needed.

Approver:

The Approver(s) is(are) the person(s) responsible for approval, amendment and deletion of all transactions created by maker(s) or another approver(s) and can view account balance and transaction history.

Maker:

The Maker(s) is(are) the person(s) responsible for creating transactions, amendments and deletion of scheduled transactions and can view account balance and transaction history.

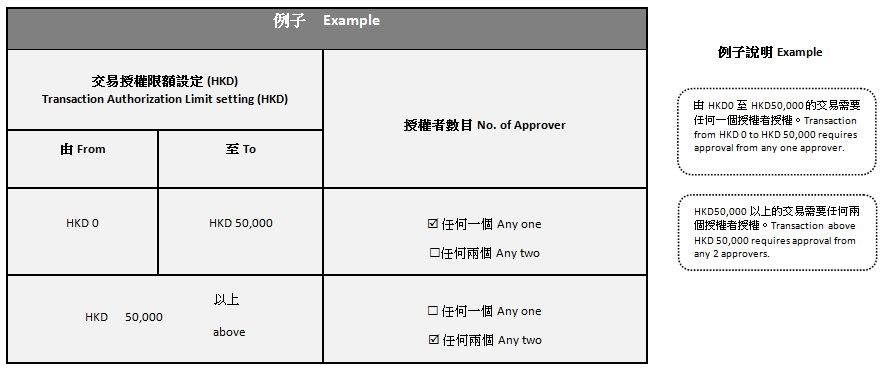

2. How many approval levels can be set?

You can set 2 levels of authorisation at maximum. You can set the authorisation level, i.e. any 1 or 2 approvers to authorise the transaction, for a transaction type and / or authorisation limit. To change your authorization settings, the applicant company should complete the relevant maintenance form, sign according to signing requirements and submit the form to any one of our branches for further arrangement.

3. What should I do if the Administrator or Approver has resigned?

If Administrator has resigned:

To protect customer's interest, if there is any change in the authorised signatory(ies) of any of your Master Company's accounts, and such authorised signatory(ies) is / are also Administrator(s) of your Master Company's 328 Business e-Banking, your Master Company is responsible for notifying us to amend the Administrator setting of your 328 Business e-Banking accordingly. Should there be any change of Administrator, the Master Company is required to complete the relevant maintenance form, sign according to signing requirements and submit the form to any of our branches to amend the Administrator setting.

If Approver has resigned:

If there is any change of Approver, the Administrator can delete that user and amend the Approver setting by going to the "Management" > "User Settings" page after logging into 328 Business e-Banking, or the applicant company can complete the relevant maintenance, sign according to signing requirements and submit the form to any of our branches to amend the Approver setting.

1. What should I do if I forgot my User ID?

Each Maker, Approver and Administrator has a unique User ID. The Administrator can go to the "Management" page to view all the User IDs of the Group under the 328 Business e-Banking after logging into 328 Business e-Banking. If the Administrator forgets his / her User ID, the director(s) of the applicant company may contact our Customer Service Hotline at 2828 8008 or the applicant company may complete the relevant maintenance form, sign according to signing requirements and submit the form to any of our branches to apply for resending of the User ID.

2. What should I do if I forgot my password?

The Administrator can reset the password for Maker and Approver by going to the "Management" > "User Settings" page after logging into 328 Business e-Banking. If the Administrator forgets his / her password, the applicant company should complete the relevant maintenance form, sign according to signing requirements and submit the form to any of our branches to request for issuance of a new password.