Offers

328 Business Account (Express)

328 Business Rewards for Customers with the Premium Status

Features

328 Business Account

328 Business e-Banking and Mobile Bankingxii

328 Business Banking Centre

328 SME Loanxiii

Merchant Services

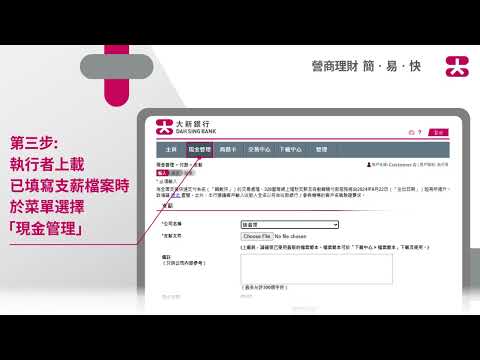

Easy Payroll Servicesxvii

Dah Sing Business Cardxviii

Dah Sing Business Multi-Currency Mastercard Debit Cardxx

Tool

Tutorial and Promotion (Chinese Only)

Eligibility

Act Now

328 Business Banking

Call Us 2828 8008

(Monday - Friday: 9:00 am - 5:45 pm)

Required Documents

328 Business Banking

Call Us 2828 8008

(Monday - Friday: 9:00 am - 5:45 pm)

Required Documents

328 Business Banking

Call Us 2828 8008

(Monday - Friday: 9:00 am - 5:45 pm)

Required Documents

328 SME Loan

Enquiry / Application 2828 8008

Download Application Form

Download Key Facts Statement (KFS)

328 SME Loan

Enquiry / Application 2828 8008

Download Application Form

Download Key Facts Statement (KFS)

328 SME Loan

Enquiry / Application 2828 8008

Download Application Form

Download Key Facts Statement (KFS)

Merchant Credit Card Acceptance Service (For Credit Card Payment Service / POS Terminal / Online Payment Enquiry only)

Download Application Form

Enquiry / Application 2828 8189

Merchant Credit Card Acceptance Service (For Credit Card Payment Service / POS Terminal / Online Payment Enquiry only)

Download Application Form

Enquiry / Application 2828 8189

Merchant Credit Card Acceptance Service (For Credit Card Payment Service / POS Terminal / Online Payment Enquiry only)

Download Application Form

Enquiry / Application 2828 8189

*If you do not provide the required information (including but not limited to Your Name) in the WhatsApp appointment, our bank staff cannot proceed to contact you to follow-up your enquiry and no separate notice will be issued.

The Promotion Period is from 1 Jan 2026 to 30 Jun 2026 (both dates inclusive).

Service features of 328 Business Banking are subject to relevant terms and conditions. For details, please click here.

Promotional offers are subject to relevant terms and conditions. For details, please click here.

To borrow or not to borrow? Borrow only if you can repay!

These services / products are not targeted at customers in the EU.